What Is Easy Way To Make Money Swing Trading

Swing Trading

Buying and selling of stocks that show an up or downward trend in the hereafter

What is Swing Trading?

Swing trading is a trading technique that traders use to purchase and sell stocks when indicators point to an up (positive) or downward (negative) trend in the future, which can range from overnight to a few weeks. Swing trades aim to capitalize on buying and selling the interim lows and highs within a larger overall tendency.

Traders apply technical indicators to determine if specific stocks possess momentum and the best time to buy or sell. To exploit the opportunities, the traders must act quickly to increase their chances of making a profit in the short-term.

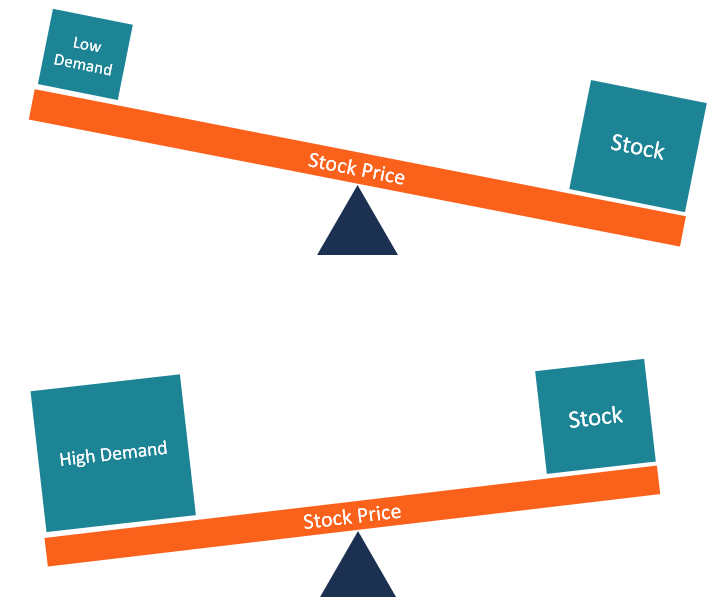

How Swing Trades Works

Swing trading seeks to capitalize on the upward and downward "swings" in the cost of a security. Traders hope to capture small moves within a larger overall trend. Swing traders aim to make a lot of minor wins that add up to significant returns. For instance, other traders may wait five months to earn a 25% turn a profit, while swing traders may earn 5% gains weekly and exceed the other trader's gains in the long run.

Nearly swing traders utilise daily charts (similar 60 minutes, 24 hours, 48 hours, etc.) to choose the best entry or exit betoken. However, some may utilise shorter time frame charts, such as 4-hr or hourly charts.

Swing Trades vs. 24-hour interval Trading

Swing trading and day trading appear similar in some respects. The principal cistron differentiating the two techniques is the belongings position time. While swing traders may hold stocks overnight to several weeks, day trades shut within minutes or before the close of the market place.

Day traders do not concord their positions overnight. It often means they avoid subjecting their positions to risks resulting from news announcements. Their more frequent trading results in college transaction costs, which tin essentially decrease their profits. They often trade with leverage in order to maximize profits from small toll changes.

Swing traders are subjected to the unpredictability of overnight risks that may result in pregnant price movements. Swing traders tin can check their positions periodically and take action when critical points are reached. Unlike day trading, swing trading does not crave constant monitoring since the trades last for several days or weeks.

Trading Strategies

Swing traders tin use the following strategies to await for actionable trading opportunities:

ane. Fibonacci retracement

Traders tin utilize a Fibonacci retracement indicator to identify back up and resistance levels. Based on this indicator, they tin can find market reversal opportunities. The Fibonacci retracement levels of 61.eight%, 38.2%, and 23.6% are believed to reveal possible reversal levels. A trader might enter a buy trade when the price is in a downward trend and seems to find back up at the 61.8% retracement level from its previous loftier.

two. T-line trading

Traders apply the T-line on a chart to make a conclusion on the all-time fourth dimension to enter or exit a trade. When a security closes above the T-line, it is an indication that the toll will proceed to rise. When the security closes beneath the T-line, it is an indication that the toll will go along to fall.

3. Japanese candlesticks

Nigh traders adopt using the Japanese candlestick charts since they are easier to understand and interpret. Traders use specific candlestick patterns to identify trading opportunities.

Additional Resources

Cheers for reading CFI's caption of swing trading. CFI offers the Majuscule Markets & Securities Analyst (CMSA)® certification program for those looking to have their careers to the adjacent level. To go along learning and advancing your career, the following resources volition be helpful:

- Long and Curt Positions

- Momentum Investing

- Trade Order Timing

- Investing: A Beginner's Guide

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/swing-trading/

Posted by: williamsarofs1951.blogspot.com

0 Response to "What Is Easy Way To Make Money Swing Trading"

Post a Comment